ANZ

Innovating everyday banking products together with ANZ

We helped ANZ understand customer needs, design a suite of everyday banking products, and create a vision for future offerings.

Outcomes

5 experience principles that reflect the needs and desires of customers, and can guide future product and service development

12 customer experience concepts, prioritised and sized, designed to reduce stress and make customers feel rewarded

Concept playbooks, including concept mockups and specifications, for each experience concept

Services

- Research

- Service design

- Product innovation

- Product strategy

Sectors

An increasingly competitive market

Traditional everyday banking products are coming under increasing competition from new fintech services such as POS lending, start-up banks and app-led experiences , which give people more options to manage their finances than ever before.

ANZ engaged Paper Giant to work together with their internal team to undertake a complete design process. We designed new and innovative products and services while coaching the ANZ team to run design processes for themselves.

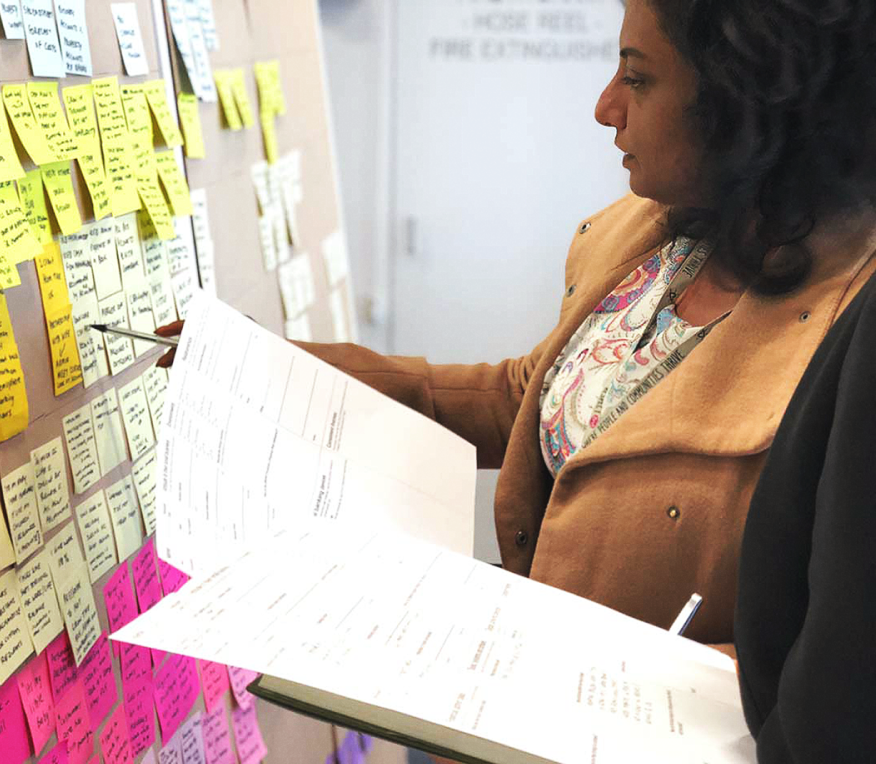

Members of the ANZ and Paper Giant team presenting insights from the research phase.

Understanding the why

The first phase of the project focused on deeply understanding people’s everyday financial needs and the drivers behind the decisions and the products they choose. Together with the team from ANZ, we ran interviews, diary studies and observational sessions with the same set of 15 people over several weeks.

This in-depth research uncovered that people often have highly emotional relationships to their money. Some people love to research and optimise every little detail – others avoid even looking at their bank balance if they don’t expect to like what they’ll see.

Money also has a complex role in different types of relationships. For example, families have significantly different needs to single people, and people within a family often have conflicting approaches to money management.

Examples of the detailed reporting provided around customer behaviours

Examples of the detailed reporting provided around customer behaviours

Meeting the customer where they are

These factors meant that every customer had created their own personal system for structuring their finances and the mix of financial products they used.

These systems generally fell on a scale between rigid systems, which were set up deliberately, and organic systems, which developed sporadically over time. The suitability of a customer’s system to their circumstances often determined how rewarding or stressful they found their finances.

This finding allowed us to identify key opportunity areas across the customer journey, where ANZ could improve customers’ existing banking experience by making their personal finance system, whatever it is, less stressful and more rewarding.

A photo from the design sprint we ran with the ANZ team

Making the most of the opportunities

We then ran a week-long design sprint, where we coached over 30 people from across ANZ through the key steps of a design process. First we immersed them in our findings, then we created potential solutions with multidisciplinary teams before testing them with potential customers at the end of the week.

There were hundreds of ideas developed over the course of the week and these formed the basis for the second phase of the project: selecting and refining those ideas so they address customer needs and opportunities.

Sample prototypes that were used to test new features and propositions with ANZ customers

Sample prototypes that were used to test new features and propositions with ANZ customers

Building a complete picture with prototypes

We then designed out more detailed service prototypes based on the ideas and tested them in-depth with customers. This approach of rapid prototyping helped us to build the ideas out into more detailed and complete product and service concepts, zooming in on the things that delivered the most value to customers and helped them to manage their financial systems better.

Examples of some of the key tools shared at the end of the project.

Developing tools for ongoing innovation

The learnings from the prototyping phase, the design sprint and the research were then brought together into a set of tools that will help ANZ continue to innovate and take the first steps to bringing new solutions to market.

These tools included a set of 5 experience principles and the experience framework, which brings to life 12 different product concepts and the steps to delivering them now, next and in the future.

ANZ now have the right insights and starting points to reduce the pain points – relieving customer stress and helping people feel in control of their money – and to boost the delight points – making sure customers feel recognised and rewarded.